SUSTAINABILITY TCFD Proposal Initiatives

The Lawson Group (hereinafter “the Group”), in order to achieve the Group Philosophy of “Creating Happiness and Harmony in Our Communities” and sustain the blessings of the Earth for future generations, has determined to operate its business while constantly considering the natural environment and local communities as well as to take proactive actions toward coexistence with local communities and sustainable development as the basic principles of the Lawson Group Environmental Policy*1.

Furthermore, in determining the Group’s Material Issues*2, we consider the issue of climate change, which is becoming more severe year by year, to be an extremely important issue. As the core company of the Lawson Group, Lawson, Inc. (hereinafter “Lawson”) endorsed the Task Force on Climate-Related Financial Disclosures (TCFD)*3 in April 2020 and decided to follow its recommendations to promote disclosure of information on governance, strategy, risk management, and metrics and targets while promoting analysis of the financial impact of climate change on the Group’s operations.

- Lawson Group Environmental Policy

- Material issues

- The Task Force on Climate-related Financial Disclosures (TCFD) was established by the Financial Stability Board (an international financial supervisory body comprising national financial ministries and central banks) at the request of the G20 to examine ways in which climate-related information should be disclosed and the response of financial institutions. The TCFD released its final report in June 2017, recommending that companies disclose information on climate change-related risks and opportunities.

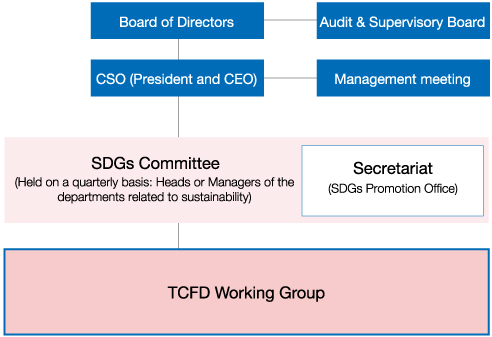

Governance

Lawson created the SDGs Committee in March 2019, aiming to help realize a sustainable society through its business activities. The committee meets four times a year and is under the direct supervision of the President. Executive directors and managers of departments related to sustainability participate in the meetings. The committee has declared its intention to engage in “sustainable environment preservation activities toward a carbon-free society,” in order to realize “Environmental (Machi) friendliness.” The committee also formulates implementation plans and manages progress toward achieving its targets (KPIs), and regularly reports to the Board of Directors on the status of efforts to address climate change and other issues.

A working group has been established under the SDGs Committee, tasked with promoting the disclosure of information related to climate change. The departments in charge of corporate strategy, accounting, and investor relations, etc., are promoting disclosure of information related to governance, strategy, risk management, as well as metrics and targets, as recommended by the TCFD. The working group analyzes risks andopportunities related to climate, grasps their impact on business strategy and revises the strategy, and examines various countermeasures formitigating and adapting to climate change. The working group will also lead efforts to strengthen disclosure of the results of these examinations.

To further strengthen our efforts to reduce greenhouse gas (GHG) emissions in our business activities and other environmental issues, on March 1, 2021, we established the position of Chief Sustainability Officer (CSO), which has been assumed by the president, CEO, and representative director.

Roles of the working group

- ●Analysis of risks and opportunities related to climate change

- ●Ascertainment of impacts on business strategy

- ●Examination of climate change mitigation and adaptation measures

- ●Disclosure of information regarding climate change-related initiatives

Strategy

(1) Identification of risks and opportunities

Lawson has established a company-wide Compliance and Risk Management Committee Meeting under the Chief Compliance and Risk Officer (CRO) to extract risks and create risk scenarios every year in the committee meeting. Furthermore, the committee evaluates each of these risk scenarios based on the impact level and frequency of occurrence. The committee categorizes risks that greatly influence our financial condition, business performance, cash flow status, and strategies as critical risks and identifies risks related to climate change as a type of major risk.

Climate change-related risks include those associated with the transition to a decarbonized economy, such as regulations on greenhouse gas (GHG) emissions, and those associated with adaption to physical changes caused by climate change, such as weather disasters of increased intensity. These risks may affect the Group’s performance and financial condition. We evaluate the level of impact on our finances based on the time when the influence of these risks and opportunities occur, as well as a simplified scenario analysis.

■Main risks and opportunities associated with climate change

・Time of occurrence and realization

Short term: Less than 3 years

Medium term: 3 to 10 years

Long term: 10 years or more

・Level of impact on finances

High: 10 billion yen or more

Medium: 2 billion to 10 billion yen

Low: Less than 2 billion yen

| Main risks and opportunities | Timing of manifestation or realization | Level of impact on finances | ||

|---|---|---|---|---|

| Transition risks | Introduction and increase of carbon pricing Tightening of GHG emissions regulations |

Increase in store operation costs due to introduction of carbon pricing | Medium term | High |

| Increase in costs of raw material procurement and manufacturing due to introduction of carbon pricing | Medium term | High | ||

| Tightening of fluorocarbon regulations | Increase in investment costs for non-fluorocarbon equipment, etc., in stores | Medium term | Medium | |

| Tightening of plastic regulations | Increase in procurement costs for substitute raw materials compliant with plastic restrictions | Medium term | Medium | |

| Increase in electricity prices | Increase in energy cost due to increase in electricity prices | Medium term | Medium | |

| Increase in costs of raw material procurement and manufacturing due to increase in electricity prices | Medium term | Medium | ||

| Changes in consumer lifestyles and preferences | Degradation of brand image due to delayed response to environmental awareness | Medium term | Medium | |

| Tightening of regulations on gasoline-powered vehicles | Expanded use of electric vehicles for business operations and delivery | Long term | Low | |

| Changes in preferences of investors | Drop in stock prices due to lowered reputation caused by delayed response to environmental sustainability | Medium term | High | |

| Physical risks | Increased severity of weather disasters | Damage due to flooding in stores, decrease in sales due to suspension of operations | Short term | High |

| Average temperature increase | Increase in electricity usage at stores, distribution centers, etc. | Long term | Medium | |

| Opportunities | Introduction and increase of carbon pricing | Decrease in raw material procurement costs due to increased efficiency in suppliers’ business processes and facilities | Medium term | Medium |

| Decrease in transport costs due to increased efficiency in logistics | Medium term | Medium | ||

| Technological development in renewable energy | Decrease in energy costs due to installation of reduced-cost solar cells | Long term | Medium | |

| Changes in consumer lifestyles and preferences | Increase in sales due to development of environmentally conscious products and services | Medium term | Medium | |

| Spread of use of energy-saving technology | Decrease in energy costs by saving energy in stores | Medium term | High | |

| Increased social awareness about food loss | Decrease in raw material procurement costs by reducing food loss | Medium term | Medium | |

| Decrease in waste processing costs by reducing food loss | Medium term | Medium | ||

| Tightening of plastic regulations | Decrease in the provision of cutlery in accordance with plastic regulations | Medium term | Low | |

| Average temperature increase | Increase in sales due to development of products and services tailored to changes in customer preferences resulting from higher temperatures | Short term | Low | |

(2) Scenario analysis

We are conducting scenario analysis for the entire Group regarding the impacts of risks and opportunities on the business with the following analysis targets. We also plan to add consolidated subsidiaries and affiliates, including our consistently expanding overseas chain-store development and operations, to the analysis targets.

| Target businesses | Domestic convenience store business (LAWSON and NATURAL LAWSON brand stores) |

|---|---|

| Scope of analysis | Lawson and franchise stores (about 14,000) |

| Analysis period | 2030, 2050 |

| Analysis theme |

①Increase in-store operating costs due to the introduction of carbon pricing ②Impact of increased severity of weather disasters on stores ③Increased net sales through environmentally conscious products |

| Main external scenarios referenced |

|

①Increase in-store operating costs due to the introduction of carbon pricing

For the Lawson and franchise stores analyzed above, we recognize that the majority of our GHG emissions are derived from electricity. If regulations are tightened and carbon pricing is introduced for emissions to mitigate climate change in the future, we would incur additional costs in the procurement of electricity. Therefore, the degree of financial impact may significantly differ depending on our electricity usage including efforts to reduce it for the future, the CO2 emission factor of the energy we procure, and the price of the electricity.

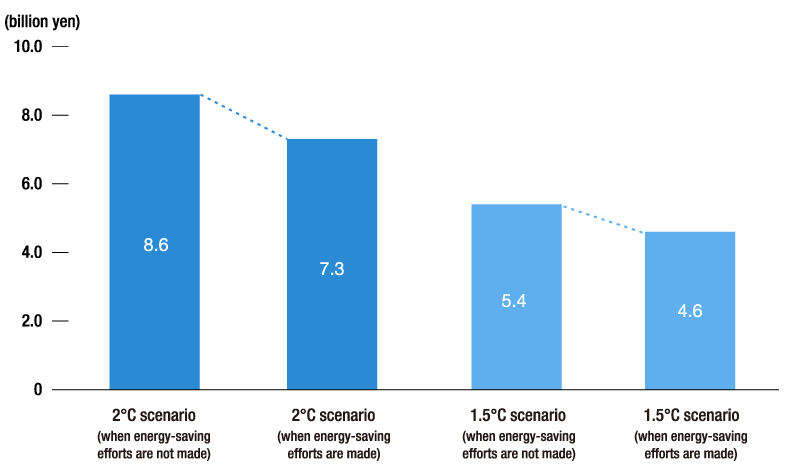

We conducted scenario analysis on how future carbon pricing will impact our operating costs in the case where Lawson conducts initiatives to save energy, which has been implemented as a material issue, based on future temperature rise scenarios (1.5°C, 2°C, 4°C).

As a result, it is forecast that, if we take measures to save energy, we will be able to reduce not only the burden of carbon pricing, but also electricity charges, as compared to when we do not take any measures, allowing the financial impact in 2030 to be suppressed by a considerable amount. We will continue to promote energy-saving initiatives aiming to work toward reducing electricity consumption by installing glass or acrylic doors on showcases for refrigerated/frozen foods or solar panels as standard for new stores.

Financial impact of carbon pricing in 2030

Carbon prices as of 2030 indicated in the IEA WEO-2022 are used for trial calculation with $135 for the 2°C scenario and $140 for the 1.5°C scenario.

In the IEA WEO-2022 scenario we used for this review, the emission factor of the electric power sector in Japan is estimated to be significantly reduced by 2050. Therefore, the analysis results suggest that the financial impact caused by the carbon price in 2050 and procurement of renewable energy would be limited. However, we understand that the results were provided assuming that society as a whole, including Lawson, proceeds with initiatives toward decarbonization. We will proactively conduct initiatives toward decarbonization by saving energy as well as introducing renewable energy by measures such as increasing the number of stores that use solar power systems.

②Impact of increased severity of weather disasters on stores

As a group, we not only prepare for large-scale disasters, but also aim to quickly restore damaged stores and resume (or continue) operations by taking various disaster response measures so as to fulfill our role as a lifeline for the community in the event of a disaster. Steps we intend to take include confirming the safety of franchise store and headquarters employees and the status of damage in the event of a disaster, as well as ascertaining the status of product deliveries at suppliers.

With an aim to establish a strong store network that can continue operations and be quickly restored in the case of a disaster, we are currently evaluating the impact of the increased severity of weather disasters on our stores. We conducted screening for the risk of immersion of stores in Japan due to floods and tidal waves, and then graded stores in five levels from A (high risk) to E (low risk). During this screening, we evaluated the potential risk of immersion based on terrain conditions even for stores that are not located in areas prone to flooding and graded them. Furthermore, for the financial impact amount generated by the increased damage from flooding and immersion due to climate change, we performed trial calculations on the expected values for an increase in expenses for restoring stores as well as a decrease in sales during the restoration period for 2030 and 2050.

As a result of analysis, it was discovered that although the risk of immersion increases due to the increased severity of weather disasters, the financial impact by 2050 caused by the increased damage due to flooding and tidal waves is limited in both the 2°C and 4°C scenarios.

For example, if a Class 1 river*4 floods in the Kanto region where many Lawson stores are located, the total restoration expenses and reduction in sales due to closing stores were calculated to be approximately 2.5 billion yen by 2030 and 9.7 billion yen by 2050 in the 2°C scenario.

*4 Arakawa River, Tama River, Edo River, Naka and Ayase Rivers, Sagami River, Fuji River, Kanna River, Karasu River, Watarase River, Kinu River, Naka River, Kuji River, Kokai River, Tone River (excluding Kasumigaura)

●Main external information sources used for this analysis

- “Point-Specific Immersion Simulation Search System” (Flooding Navi) and “Overlay Hazard Map” by the Ministry of Land, Infrastructure, Transport and Tourism of Japan

- Maps of areas prone to flooding and tidal waves disclosed by prefectural governments

- WRI Aqueduct Floods Hazard Maps

- IPCC AR6 Climate Change 2021: The Physical Science Basis

- IPCC Working Group 1 Interactive Atlas

- Yukiko Hirabayashi et al. (2013). Global flood risk under climate change. Nature Climate Change, 3(9), 816-821.

[Results of trial calculation of increased amount for store restoration expenses

in accordance with future changes in flood occurrence]

(Evaluation target: Stores located near Class 1 rivers in the Kanto region)

(billion yen)

| Increased amount of store restoration expenses | 2°C scenario (RCP2.6) | 4°C scenario (RCP8.5) | ||

|---|---|---|---|---|

| 2030 | 2050 | 2030 | 2050 | |

| Single year | 0.21 | 0.24 | 0.22 | 0.29 |

| Cumulative total*5 | 1.55 | 6.07 | 1.58 | 6.75 |

*5 Cumulative total from 2023

[Results of trial calculation of decrease in sales during restoration period

in accordance with future changes in flood occurrence]

(Evaluation target: Stores located near Class 1 rivers in the Kanto region)

(billion yen)

| Decrease in sales during the store closure period | 2°C scenario (RCP2.6) | 4°C scenario (RCP8.5) | ||

|---|---|---|---|---|

| 2030 | 2050 | 2030 | 2050 | |

| Single year | 0.13 | 0.14 | 0.13 | 0.17 |

| Cumulative total*6 | 0.92 | 3.59 | 0.94 | 3.98 |

*6 Cumulative total from 2023

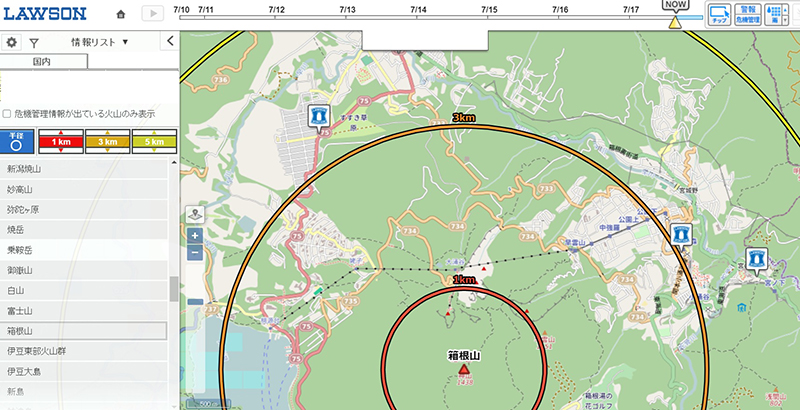

Based on these analysis results, we will review the business continuity plan (BCP), prepare disaster control manuals, and carry out training programs and drills for employees to be able to continue store operations. We will also grasp an understanding of the impact on our business strategies and finances while taking various measures to review these strategies and adapt to climate change*7. Furthermore, when a disaster is expected to occur due to a typhoon, heavy rain, or heavy snow, we establish a headquarters for disaster control in advance and secure the safety of customers and employees by closing stores in a planned manner and taking other measures.

■Examples of initiatives to continue store operation

- Identification of evacuation sites based on hazard maps

- Introduction of a disaster information map system for quickly sharing information on damage to stores and supporting these stores

- Reviewing construction methods for store equipment in order to secure an electric system in the event of water damage

▲ Disaster information map system

③Increased net sales through environmentally conscious products

Lawson responds to changes in communities and customer needs, and works to solve social issues while promoting initiatives to decrease the environmental burden through decarbonization and the reduction of food loss as well as the use of plastic. In response to recent changes where customers are becoming more environmentally conscious, we plan to develop new products and services while formulating measures to contribute to environmental preservation in order to expand opportunities to sell environmentally conscious products as much as possible.

An example is the MACHI café coffee service where coffee is freshly made in stores only using coffee beans produced in Rainforest Alliance Certified farms*8. We also sell soft drinks in paper cups and paper packs made of materials with forest certification*9 as part of our initiatives to develop and sell sustainable, certified products. We carried out scenario analysis to see whether or not there will be certain opportunities to expand sales of these environmentally conscious products during the transition to a decarbonized economy.

During the analysis, we examined variations in net sales of environmentally conscious products based on the factor of changes in “generation-specific percentages of customers purchasing environmentally conscious products” in order to understand future changes in customers’ environmental consciousness and estimate the impact on demand for the products we sell.

In a society shifting toward decarbonization, the number of people who purchase environmentally conscious products is estimated to increase over time.

Environmentally conscious products that we develop have a certain appeal to highly environmentally conscious customers in a decarbonized society. For this reason, we believe that we will have an opportunity to increase sales of such products as the percentage of people who purchase them increases.

Net sales of environmentally conscious products

| Carbon-free society | |

|---|---|

| 2030 | 2050 |

| Approx. 6.5 billion yen | Approx. 19.4 billion yen |

As a result of this scenario analysis, we plan to increase the sales of environmentally conscious products by appropriately responding to increases in customers’ environmental consciousness while contributing to a sustainable society via initiatives to develop and provide environmentally conscious products as society shifts toward decarbonization.

*8 Mocha Blend and Decaffeinated Series are not of the scope.

*9 For a More Sustainable Society: Development and Sale of Products Using Certified Raw Materials

(3) Policy and initiatives going forward based on analysis results

Lawson has identified climate change-related risks and opportunities, and conducted analysis of their impact on the business based on the 2°C and 4°C scenarios. Going forward, we will strive to further enhance our initiatives.

In addition, with the recent increase in momentum on climate change issues around the world, there has been significant activity in Japan and globally in terms of creating policies, laws, and regulations regarding climate change. Under these conditions, we will work to revise our business strategies and increase the accuracy of our analysis, partly to promote countermeasures that contribute to climate change mitigation and adaptation. Furthermore, by disclosing the results of this analysis, we will respond to the demands of our stakeholders.

Risk management

Lawson identifies risk factors that may inhibit the achievement of organizational goals among events that may influence the achievement of these goals and takes measures to prevent and minimize such risks by predicting and preventing risks, responding to risks when they occur, and making improvements systematically after risks are dealt with.

We have established departments in charge of risk management, formulated risk management-related regulations, and created a group-wide system to prevent risks during normal times. In each department as well, we identify risks that may greatly influence management related to our business goals, analyze the probabilities of such risks occurring and the level of their impact, assess the risks to see if they require intensive measures, and take measures in accordance with the characteristics of the risks. The analysis/assessment results and measures against risks are reported at Executive Committee Meetings and other meetings where the members discuss responses to major risks that are recognized to have a potential to cause a critical impact on management. Regarding the execution of especially important operations, any risks related to the relevant issue are identified, and measures against them are checked and discussed in advance before making decisions at the Board of Directors or Executive Committee Meeting and then executing these measures.

We analyze and assess the probability of risks occurring and the level of impact caused by such risks on the Group. We assess risks based on the level of impact, such as the scale of damage, as well as their occurrence frequency from recent trends, and visualize the results as a corporate risk map. For the identified risks, we discuss measures against them according to their level of importance based on the analysis/assessment results from checking their occurrence frequency and level of impact. Then, we determine how to respond to them including avoiding or reducing these risks, or transferring the risks by taking out insurance.

We consider climate-related risks to be major risks among management strategy risks. We analyze/assess the probability of these risks surfacing, new risks occurring in the future, and the level of impact of the risks, and evaluate the level of impact on our business. Then, we discuss responses according to the degree of importance of the risks and determine how to respond to them including avoiding or reducing these risks, or transferring the risks by taking out insurance.

Metrics and Targets

In light of social issues and circumstances, we have set goals (KPIs) related to social and environmental aspects and are working to achieve them by 2025, the 50th anniversary of our foundation, and by 2030, the target year of the SDGs. Furthermore, in an effort to contribute to the formation of a decarbonized society and the vision of the SDGs, we have taken on the challenge of even higher targets (reducing CO2 emissions, reducing food waste, reducing plastic) in our Environmental Vision, Lawson Blue Challenge 2050 ! “Save our blue planet!”

To accelerate efforts to tackle climate change, we submitted a commitment letter to the SBT Initiative as an accreditation body in June 2022, aiming to obtain SBT Certification*10 that the Group’s greenhouse gas reduction targets align with the Paris Agreement.

In addition to aiming for certification, we identify targets for GHG emissions associated with our business activities, collect data, promote reduction activities, and set reduction targets, including consolidated subsidiaries and affiliates.

*10 SBT: Science Based Targets. These are greenhouse gas emission reduction targets set by companies that are consistent with the levels required by the Paris Agreement. Targets must be set 5 to 10 years ahead, with an aim of reducing emissions by 4.2% or more per year.

The SBT Initiative:An international initiative jointly established by the World Wide Fund for Nature (WWF), the CDP, an international NGO working on environmental issues, the World Resources Institute (WRI), and the United Nations Global Compact (UNGC).