SUSTAINABILITY Corporate Governance

Basic Concept

We place great importance on stakeholder under Group Philosophy “Creating Happiness and Harmony in Our Communities,” and strive to maximize enterprise value by making Lawson stores a place where -

- the customer is always made to feel welcome

- franchised store owners can feel that they are realizing their full potential

- store crew members(part-time staff and workers) on short-term contracts can develop their skills and grow as a result of their own efforts

- suppliers and service providers see their dreams take shape

- employees can take pride in their work and really feel a sense of being useful to the society

- shareholders can contribute indirectly to society and invest in their dreams for the future, and

- members of customer communities can feel welcome and safe

These are our goals, and the realization of these objectives will contribute to the maximization of enterprise value.

To this end, we believe that it is important not only to comply with laws and regulations and social norms but also to increase the soundness of management and enhance corporate governance through the practice of considerate behavior based on the Group Philosophy and the Lawson Code of Ethics combined with proactive disclosure.

Corporate Governance and Internal Control Systems

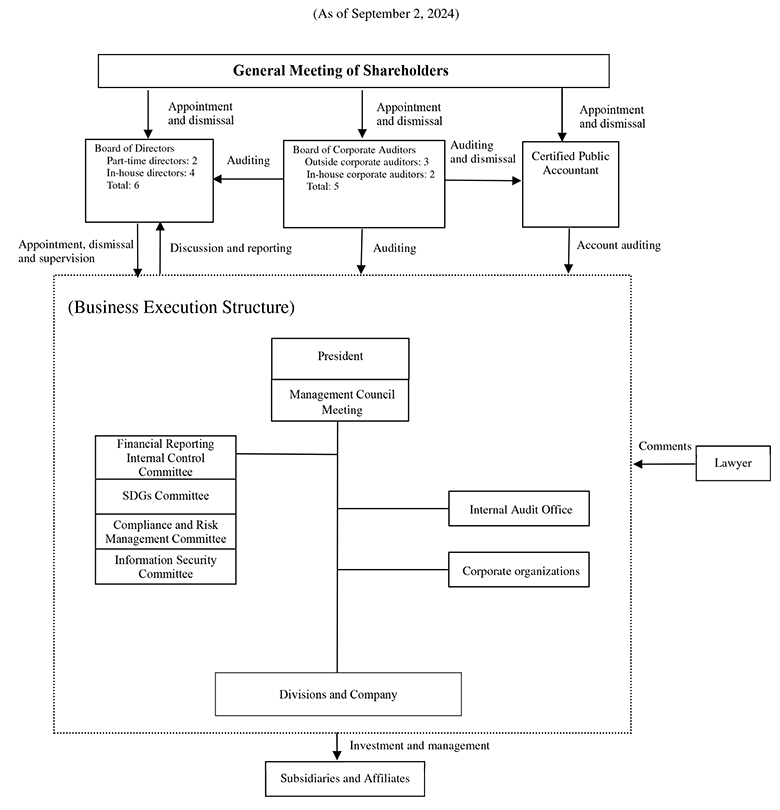

Board of Directors, Audit & Supervisory Board, and Accounting Auditors

Lawson adopts an Audit & Supervisory Board Member system with five Audit & Supervisory Board Members, including three outside Audit & Supervisory Board Members, auditing the roles and responsibilities of directors.

The Company’s Board of Directors is made up of six directors, including four full-time and two part-time. The Board of Directors not only decides important management matters, such as issues stipulated by laws and regulations and the Articles of Incorporation, but also supervises the roles and responsibilities of directors.

Furthermore, the Company has adopted an executive officer system and entrusts authority to executive officers to expedite business execution.

Moreover, the Company holds management meetings as a supplementary decision-making body to the Board of Directors. The management meeting comprises personnel who are generally of executive managing officer level or above and members designated by the president and CEO.

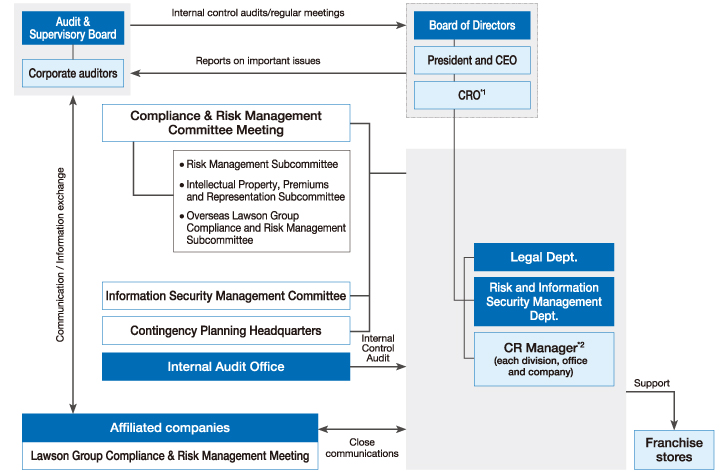

To ensure the effectiveness of the compliance system and risk management system, the Company has a Compliance and Risk Management Committee and a Financial Reporting Internal Control Committee.

The Internal Audit Office serves as the Company’s internal audit division that directly reports to the President. This office conducts business audits, including audits of affiliated companies, to identify problems and provide guidance for improvements.

The Company has five Audit & Supervisory Board Members, including three outside Audit & Supervisory Board Members. The Audit & Supervisory Board Members attend meetings of the Board of Directors and other important meetings where they express their opinions and inspect important documents, thereby auditing the roles and responsibilities of directors.

The Company has signed an audit contract with Deloitte Touche Tohmatsu to conduct financial audits and undergoes audits.

There are no special relationships of interest between the accounting auditor and the Company. In close liaison with the Audit & Supervisory Board Members and the directors, the accounting auditor reports audit plans and audit results, while exchange necessary information and opinions throughout the term, thereby conducting efficient and accurate audits.

Basic Policy Regarding the Internal Control System

The business of Lawson Group encompasses a wide-range of operations, from the core business of convenience stores to high-end supermarkets and entertainment-related business, to financial, e-commerce, and consulting services. We operate a large number of LAWSON stores, covering every prefecture in Japan and several markets overseas, each of which offers a wide variety of products and services. As such, we are not only required to observe various laws and regulations but also we should assess the diverse range of possible risks and implement the appropriate countermeasures. In light of these characteristics, Lawson has established the “Basic Policy for Regarding the Internal Control System” to achieve healthy, sustainable growth. We are promoting maintenance of our internal control system based on this policy, while responding to changes in our management environment, conducting periodical reviews of the policy itself, and endeavoring to maintain and enhance an effective, practical internal control system.

Lawson’s internal control system (as of September 1, 2024)

- CRO (Chief Compliance and Risk Officer): The executive with overall responsibility for the legal compliance and risk management system and framework in Lawson Group

- CR Manager: Persons responsible for the development and implementation of a framework for identifying misconduct and problems concerning legal compliance and preventing risks from arising in the group where they belong, to support CRO