Member of the Board Executive Managing Officer, Chief Financial Officer

Satoshi Nakaniwa

(Unit: Billion yen)

| (Fiscal year) | 2018 | 2019 | |

|---|---|---|---|

| YoY | |||

| Gross operating revenues | 700,647 | 730,236 | +4.2% |

| Operating income | 60,781 | 62,943 | +3.6% |

| Ordinary income | 57,700 | 56,346 | −2.3% |

| Net income | 25,585 | 20,108 | −21.4% |

Looking back on fiscal 2019, we see intensified competition across industrial borders, increased labor shortages and rising labor costs. These were accompanied by numerous other challenges for convenience stores, including reexaminations of the efficacy of 24-hour operations and the relationship between Headquarters and the franchise stores. The operating environment changed considerably, as the consumption tax was raised in October, a reduced tax rate was applied to the convenience store industry, and a cashless return system under which the government returns 2 percent of the amount spent by customers who pay in a form other than cash was instituted for selected stores. Intent on becoming the store of choice for a wide range of customers, we worked intently under these circumstances to strengthen our evening and nighttime business, develop attractive products that meet customer needs, and present clean, cheerful stores with attentive services. Faced by such conditions as the ongoing labor shortage and rising labor costs, meanwhile, we continued to support our franchise stores by optimizing store operations and reducing their workloads and manpower requirements.

Same store sales in the domestic convenience store business rose by 0.1% from the year before as we expanded our product lineup by reinforcing our evening and nighttime operations, and achieved solid sales of such original Lawson products as desserts, bakery items and enhanced bread products. Customer traffic declined by 1.6% from the previous year in a fiercely competitive environment that extended beyond industry borders. The customer unit price rose by 1.7% from the previous year, meanwhile, impacted by an increase in the price of cigarettes, a rise in evening and nighttime purchases and sales of higher priced products such as desserts.

We concentrated on opening higher quality stores during the year, and worked to create a muscular profit structure by reorganizing underperforming stores. Despite a contraction of the store network by 215 stores accompanying the opening of 554 stores and closure of 769, our strategic reorganization proceeded largely according to plan. As a result, we had 14,444 stores in Japan at end February 2020. The number of overseas stores expanded by 708 to 2,918, meanwhile, due in large part to a significant increase of 639 stores in China.

In our fiscal 2019 consolidated operations, meanwhile, the abovementioned increase in revenues from the domestic convenience store business was accompanied by strong performances from Seijo Ishii and our entertainment-related businesses and an increase in the number of overseas stores. Both net sales by all stores in our consolidated network and total consolidated operating revenues improved as a result, with the former registering 2,506.9 billion yen (up 3.4% year-on-year) and the latter 730.2 billion yen (up 4.2%).

In the area of profitability, Lawson Inc. not only sought to benefit from the effects of its reorganization of underperforming stores, but also to cut disposal losses by the franchise stores and reduce Headquarters’ costs. Despite these efforts, increased IT-related expenses stemming from support for the franchise stores and updating of store computers resulted in a decline in operating income of 900 million yen from the previous year to 44.7 billion yen.

Operating income achieved by Lawson’s consolidated Group subsidiaries rose to 62.9 billion yen (up 3.6% year-on-year), a result boosted by profits attained by Seijo Ishii and our entertainment-related businesses, both of which recorded strong sales, along with the cost-reduction effect of our financial sector operations. Profit increased by 2.1 billion yen from the previous year. As concerns consolidated ordinary income and net income, meanwhile, ordinary income registered 56.3 billion yen, a decrease of 1.3 billion yen from the previous year, while net income slipped to 20.1 billion yen, a downturn of 5.4 billion yen owing to the recording of losses in connection with the consolidation of underperforming stores.

With the new COVID-19 infection spreading worldwide in the current fiscal year, the Japanese government issued a state of emergency that lasted from April to May. This has had a significant impact on the domestic and international business environment. In the domestic convenience store business, daily sales by existing stores fell by 4.8% from the previous year due to a precipitous decline in sales by stores in locations such as business districts as many people abstained from leaving home to work. Buffeted by related costs, Lawson’s operating income is expected to decrease by 19.7 billion yen from the preceding year. In its entertainmentrelated businesses, the Company’s first-half sales are expected to suffer a significant decline due to event postponements and cancellations, with circumstances such as the postponement of movie releases adding to the problems. These factors are expected to result in a downturn in sales of 8.2 billion yen from the preceding year and to consolidated operating income of 35 billion yen (representing a decrease in profit of 27.9 billion yen from the previous year), with estimated consolidated net income registering 5 billion yen (down 15.1 billion yen from the year before).

Despite the unprecedented nature of the surrounding business environment in fiscal 2020, we continue to stress the importance of stable franchise store management and our pursuit of efforts to improve their profitability. Turning our thoughts to "things Lawson can do now," we will conduct business in close cooperation with our franchise stores with the aim of becoming an "indispensable presence in the life of the community.”

Fully conscious of the level of capital costs that reflects our profit expectations, we are raising our ROE (return on equity), an indicator of capital efficiency and an important management index, in an effort to generate profits exceeding our target level and to maximize corporate value over the medium to long term. In our commitment to achieving sustainable growth, meanwhile, we observe financial discipline by preserving/improving our net debt-to-equity ratio while promoting asset value replacement and improved financial efficiency Groupwide.

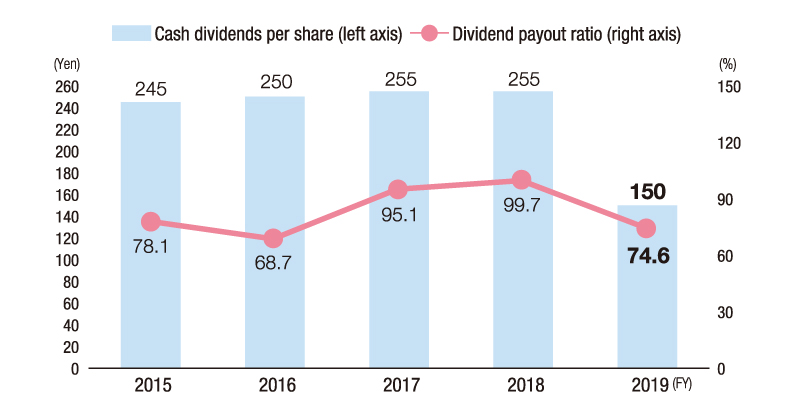

Finally, as concerns dividends, we revised our dividend policy in fiscal 2019 by introducing a “consolidated dividend payout ratio.” Our focus on returns to shareholders’ remains unchanged. We will pay the highest dividend possible within this dividend payout ratio, while continuing to invest in supporting our franchise stores and improving their profits to assure sustainable growth. With this in mind, we have established a minimum annual dividend of 150 yen per share and a return to shareholders targeting a consolidated dividend payout ratio of 50%." We have accordingly set a dividend of 150 yen per share for fiscal 2019 and an annual dividend in the same amount of 150 yen per share for fiscal 2020. Although the impact of the new COVID-19 pandemic will drive profits down in fiscal 2020, this annual dividend of 150 yen per share is the lower limit for dividends according to our current dividend policy.

We consider stable provision of safe, secure products as the proper path to realizing Lawson’s Group philosophy of "Creating Happiness and Harmony in Our Communities." With this in mind, our executive officers, employees, and franchise store owners and crews will combine forces to overcome the difficulties posed by the COVID-19 pandemic.

Transitions in cash dividends per share and dividend payout ratio