Fiscal 2020 in review

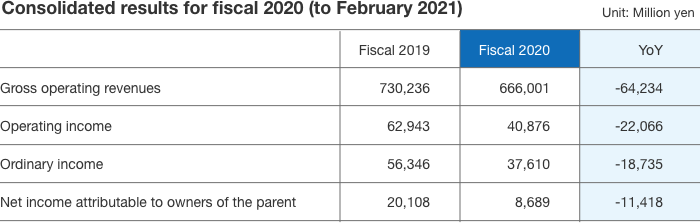

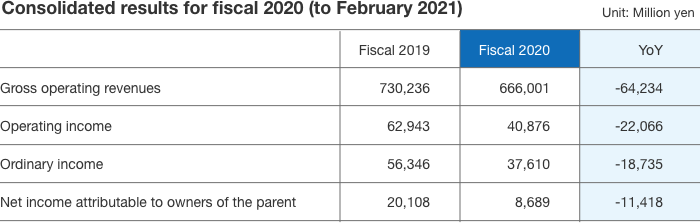

Fiscal 2020 was heavily impacted by the COVID-19 pandemic, including changes in customers' lifestyles and purchasing behavior. Even in this adverse management environment, the Lawson Group remained constantly beside customers and society as a “hub of refreshment in every community,” rising resolutely to meet the challenge. Despite these efforts, we were unable to avoid a fall in profit compared to fiscal 2019, with operating income of 40.8 billion yen and net income attributable to owners of the parent of 8.6 billion yen.

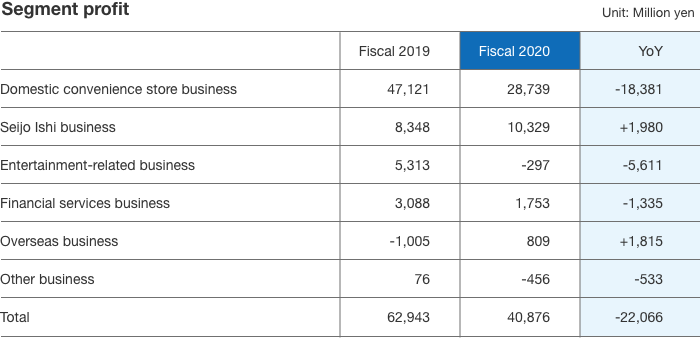

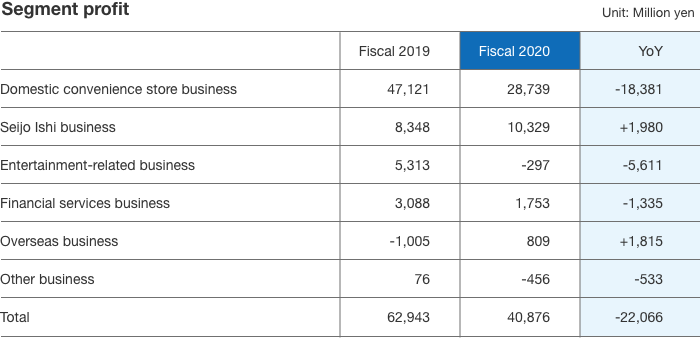

Existing store sales in the domestic convenience store business decreased by 7.3% from the previous year, while customer traffic declined by 14.2% from the previous year due to the spread of remote working and a decrease in opportunities for going out. Spending per customer rose by 8.0% from the previous year, mainly reflecting growth in frozen foods, daily foods, and fresh foods, as product lineups were expanded in response to an increase in customers eating at home. Despite continuous cost reduction efforts, the impact of existing store sales was significant for the domestic convenience store business, resulting in segment profit of 28.7 billion yen (down 18.3 billion yen from the previous year).

The pandemic had an especially prominent impact on the entertainment-related business, which recorded a segment loss of 0.2 billion yen (a deterioration of 5.6 billion yen from segment profit in the previous year). While the adverse management environment continued throughout the year, Lawson Entertainment worked to expand sales of online live streaming tickets and the e-commerce business as events continued to be cancelled or downscaled. At United Cinemas, we were forced to suspend operations at all cinemas at one point, but in the second half of the fiscal year there were some hit movies featuring popular animation.

In the Seijo Ishi business, our operations were supported by growth in supermarket demand from consumers obliged to stay at home, resulting in segment profit of 10.3 billion yen, (up by 1.9 billion yen from the previous year). Meanwhile the overseas business turned profitable, registering a segment profit of 0.8 billion yen, (an improvement of 1.8 billion from the previous year), mainly reflecting the China business, which rebounded quickly from the impact of COVID-19.

In this way, the Lawson Group experienced both positive and negative influences in each segment. However, net income attributable to owners of the parent came to 8.6 billion yen, (a decrease of 11.4 billion yen from the previous year), mainly due to factors increasing and decreasing operating income, the recording of an impairment loss related to stores in extraordinary loss, and losses related to the COVID-19 pandemic, despite recording a gain on sale of cross-held shares in extraordinary income.

Adoption of a lean profit structure to help achieve management targets

In fiscal 2020, despite the adverse management environment, we focused on reducing costs. Profits at franchise stores, began to increase year on year from the second quarter onward, mainly as a result of efforts to reduce the three main costs— food waste loss, labor cost, and utility cost. We also worked to review advertising using digital technology and took steps to reduce land rents.

Under Challenge 2025, our vision formulated for the Lawson Group’s 50th founding anniversary in 2025, we are working under the guidance of the Sweeping Transformation Executive Committee to execute further profit structure transformation. For example, in our customer-centric supply chain reform project and our vendor distribution project, we are using artificial intelligence (AI) and digital transformation (DX) to reduce both wastage loss and opportunity loss at stores and in the supply chain. Through efforts such as these, we will promote the adoption of a lean profit structure for the Lawson Group.

In our full-year plan for fiscal 2021, we have assumed that the COVID-19 pandemic will still need more time to be controlled, despite the steady spread of vaccinations. On this basis, having factored in an improvement in existing store sales, mainly due to merchandise assortments of products aligned to changes in customer needs and a recovery in the entertainment-related business, our plan for the fiscal year is for consolidated operating income of 50.0 billion yen (up 9.1 billion yen year on year) and net income attributable to owners of the parent of 13.5 billion yen (up 4.8 billion).

Preserving a sound financial position and shareholder returns

Under Challenge 2025, we are aiming to achieve return on equity (ROE) of 15% or higher, and we will strive for EPS of 500 yen or higher, representing a level of net profit that could support a consolidated dividend payout ratio of 50%. The Lawson Group emphasizes ROE, reflecting the importance that we place returning profits to shareholders. In order to improve each of the elements of ROE, which is expressed as “net profit margin × total asset turnover × financial leverage” we will promote the abovementioned adoption of a lean profit structure, and also a lean financial position by using investment criteria based on the cost of capital and replacing existing investments. At the same time, having Lawson Bank, Inc. as a member of the Lawson Group means that preserving a sound financial position leads to favorable financing conditions and improved earnings capability. As the Lawson Group continues its sustainable growth, I believe it will be important to practice a balanced approach to management, preserving a sound financial position while enhancing capital efficiency.

Moreover, we also consider shareholder returns to be an extremely important management priority. Our approach to the consolidated dividend payout ratio is to preserve a sound financial position, while making a return of profit to shareholders commensurate with earnings. On this basis, we have set the lower limit of dividends at 150 yen per share, with plans to grow the dividend sustainably through sustainable profit growth under Challenge 2025, while maintaining the necessary internal reserves for future business development.

Growth investments by the Sweeping Transformation Executive Committee with an emphasis on capital efficiency

In addition to the rapid changes in our customers and markets, various technological innovations are also in motion. To make appropriate investments utilizing the latest technologies, the Sweeping Transformation Executive Committee drafts investment plans that involve working rapidly through PDCA cycles to make daily updates and act flexibly and continuously.

One such investment is the project for pursuing the ideal store format in the domestic convenience store business. In this project, we plan to invest 32.0 billion yen on 5,000 stores in 2021. We are looking at store renovation that varies to suit characteristics such as commercial area, location, and customer base, and we are currently in the process of detailed testing. Meanwhile, in the Seijo Ishi business, we are planning an addition to the central kitchen to keep pace with increased demand from customers, as well as an increase in store numbers in the overseas business, which has turned profitable. We aim to increase the investment efficiency of the Lawson Group by increasing the precision of our risk and return calculation for investments and realizing the maximum effect from growth investments that emphasize capital efficiency.

Commitment to the SDGs through the ESG management

With regard to environmental issues, we will take steps to reduce food loss, plastic use, and CO2 emissions through Lawson Blue Challenge 2050!, our environmental vision for 2050. As part of these efforts, we will replace store-related assets with environmentally compliant alternatives in the process of investing for renovating and renewing existing stores.

The capital markets are paying close attention to environmental, social and governance (ESG) investment, and the Lawson Group has expressed its commitment to the Sustainable Development Goals (SDGs). As a convenience store chain, which is part of social infrastructure, we have already taken measures to tackle social issues in the community directly, such as making contributions to local communities and taking countermeasures for labor shortages, guided by the Group philosophy, “Creating Happiness and Harmony in Our Communities.” We set our role as being the same as ever, to engage with the SDGs through ESG management as an extension of our existing activities. Regardless of the market environment, the Lawson Group is committed to being the No. 1 recommendation of its customers and community and will continue working to achieve sustainable growth and create corporate value.