Member of the Board Senior Vice President, CFO

Satoshi Nakaniwa

Fiscal 2018 marked the conclusion of our 3-year Group-wide 1,000-Day Action Plan. We made the most of this final year of the Plan by conducting a major overhaul of our supply chain to reinforce the stores’ evening and nighttime operations. We also completed installation of the new POS cash registers with automatic change dispensers in all our stores in Japan as a labor shortage countermeasure.

A look back over fiscal 2018 shows that we strengthened our evening and nighttime operations through such measures as expanding our lineup of appropriate products such as rice balls and boxed meals and adjusting the supply chain to meet new demand from homemakers and seniors. These efforts resulted in increased sales. At the same time, however, severe competition from such businesses as other convenience stores, restaurants and drug stores prevented us from improving sales to our core convenience store customers. Sales by existing LAWSON stores in Japan declined by 0.5 percentage point from the year before as a result.

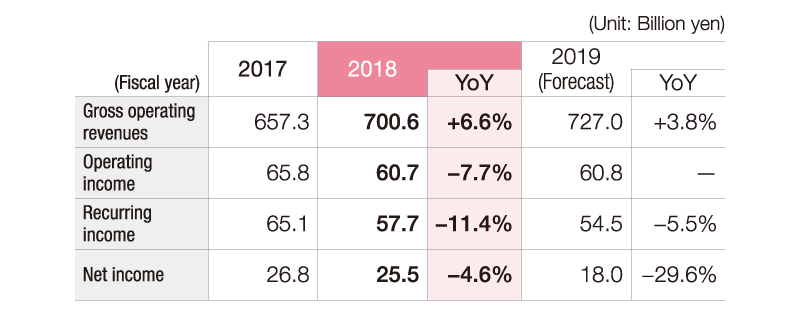

Lawson opened 1,067 stores and closed 400 in its domestic convenience store business in fiscal 2018 for an increase of 667 stores to 14,659 stores nationwide. We continued to expand our Chinese operations, moreover, increasing the number of overseas stores by 614 to 2,210 stores. This expansion of the store networks in Japan and overseas resulted in consolidated store sales of 2,424.5 billion yen (up 6.2% from the previous year) and gross operating revenues of 700.6 billion yen (up 6.6%). Both figures were improved from the previous year.

Consolidated operating income for the year registered an anticipated decline with respect to our earlier plan, however, as a result of initiatives implemented to assure sustainable growth, including investment of some 4 billion yen in nextgeneration systems and expenses of approximately 2 billion yen incurred for the establishment of the new Lawson Bank business. In the area of nextgeneration systems investment, we enhanced our operating efficiency by completing the planned introduction of new POS cash registers. As concerns Lawson Bank, meanwhile, we acquired a banking business license in August 2018 and initiated banking services for customers in October. Advertising and promotional expenses associated with the Bank’s opening and costs related to the introduction of new software contributed to the aforementioned downturn in profitability.

Among other consolidated Group subsidiaries, our Seijo Ishii and entertainment businesses continued to enjoy steady growth, and our overseas operations registered significantly improved earnings. Due to these and other factors, consolidated operating income declined by 5.0 billion yen from the previous year to approximately 60.7 billion yen (down 7.7%). As concerns consolidated net income, meanwhile, although impairment losses by the stores increased, the positive impact of appropriation of an IT system impairment loss in the previous fiscal year contributed a relatively limited year-onyear decrease of 1.2 billion yen to 25.5 billion yen.

The Company’s business environment remains austere, with a tight labor market, rising labor costs and intensifying competition across industries. In the domestic convenience store business, efforts to support our franchise stores under the Group-wide 1,000-Day Action Plan implemented in 2016 will be extended through 2019.

Our business plan for fiscal 2019 is designed to respond to the rapidly changing social environment by anticipating expenses and supporting the franchise stores through such means as optimizing the efficiency of store operations and investing in labor-saving systems to secure operating income of 60.8 billion yen, largely unchanged from the year before.

We plan to limit the number of new store openings to 700 with the aim of improving our store quality further, moreover, while disposing of underperforming stores and replacing them with more profitable stores to enhance our overall franchise store profitability. We intend to close 700 stores as well, thus avoiding any net increase in the number of stores.

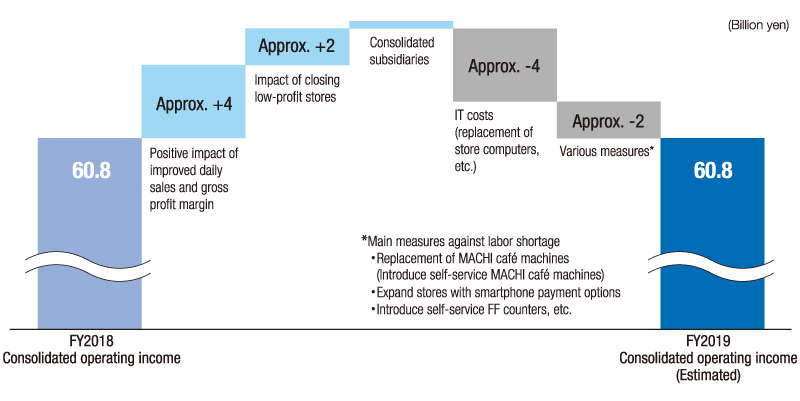

Consolidated operating income is expected to remain unchanged from fiscal 2018. Factors determining the Company’s performance will begin with an anticipated upturn in sales by existing LAWSON stores of 0.5% and an improved gross profit margin of 0.2%. We also expect the disposal of underperforming stores to contribute to improved profitability. At the same time, however, expenditures in support of the franchise stores, including system investment to update their computers, can be expected to rise. We project downturns in consolidated recurring profit of 3.2 billion yen to 54.5 billion yen and in consolidated net income of 7.5 billion yen to 18 billion yen, moreover, due to higher losses stemming from store closures.

In businesses other than our domestic convenience store operations, our new financial services arm Lawson Bank will continue to develop infrastructure to support its bill payment business centered on ATM services, which is progressing steadily in concert with the cashless society. Our overseas businesses will seek to expand the scale of their operations in the medium to long term, led by our Shanghai subsidiary in China. We will promote Group-wide growth, meanwhile, beginning with Seijo Ishii, whose specialty products have generated steady growth, and our businesses in the entertainment field.

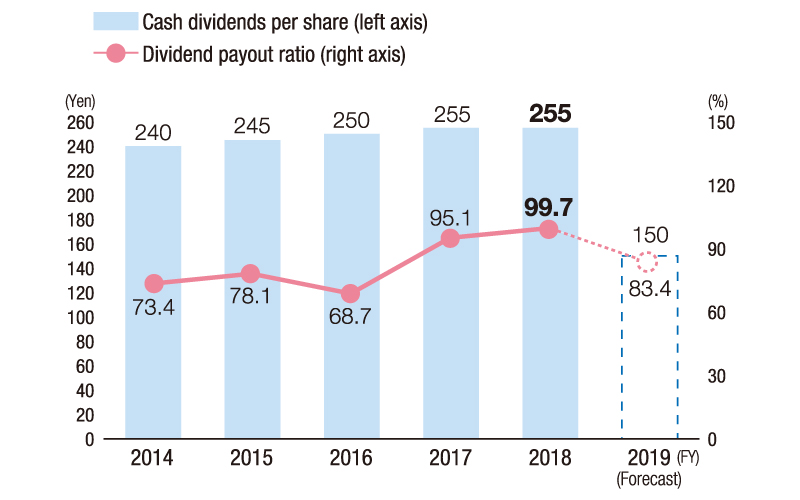

Finally, Lawson’s annual shareholders’ dividend for fiscal 2018 will remain unchanged at 255 yen per share. We have, however, adopted a new dividend policy for fiscal 2019. Having identified the return of profits to shareholders as an important management issue, the Company has paid stable dividends in recent years. Going forward, however, we will implement a policy of returning profits appropriately in response to our business results in the interest of maintaining financial health. We plan to clarify the distribution of profits to shareholders by introducing a “consolidated dividend payout ratio” as a cornerstone of our dividend policy. Without averting our focus from shareholders, we will continue investing to achieve sustainable growth by supporting our franchise stores and securing their profitability, while realizing the highest dividend possible within the range of a consolidated dividend payout ratio targeting 50% and a minimum annual dividend of 150 yen per share.

In fiscal 2019, we will concentrate on supporting our franchise stores and further strengthening relationships with our franchise owners, thus raising Lawson’s corporate value through mutual consideration and mutual prosperity with our owner-operated franchise stores in a concerted effort to recover profitability from fiscal 2020 forward, and to realize an early increase in dividends.

Transitions in cash dividends per share and dividend payout ratio

Fiscal 2019 Consolidated operating income